Xe Stock Price: Navigating the Future of X-Energy's Xe-100 Reactor

X-Energy's Xe-100 small modular reactor (SMR) is generating significant interest in the renewable energy sector, sparking questions about the potential trajectory of its stock price. This analysis explores the technological advancements, market dynamics, and inherent risks associated with this innovative technology to provide a comprehensive perspective for investors. Will this advanced reactor design translate into a robust return on investment? Let's delve into the details.

The Xe-100: Redefining Nuclear Power?

The Xe-100, a High-Temperature Gas-Cooled Reactor (HTGR) SMR, boasts a unique design featuring tiny, coated uranium fuel particles. This design significantly enhances safety by virtually eliminating the possibility of a meltdown. This pivotal advancement, coupled with a smaller footprint and faster construction time, positions the Xe-100 as a potentially more cost-effective and efficient alternative to traditional nuclear power plants. Its modular design also allows for diverse applications, potentially extending beyond electricity generation to provide industrial process heat. This versatility could significantly expand the market and drive future growth. But how likely is this to materialize? The commercial success of the Xe-100 will considerably influence the Xe stock price.

Market Analysis: Competition and Challenges

While the Xe-100 presents a compelling technological advance, several factors could impact its market success and subsequent stock price. Securing sufficient funding for development and deployment presents a significant hurdle. Regulatory approvals, a lengthy and complex process, pose additional delays. Furthermore, public perception of nuclear energy remains a challenge to overcome despite the inherent safety improvements of the Xe-100 design. X-Energy also faces stiff competition from other companies developing SMRs. To gain market share, X-Energy must demonstrably prove its reactor's superior cost-effectiveness and operational efficiency throughout its lifecycle. Is the market truly ready for this level of innovation? Only time will tell.

Risk Assessment: A Balanced Perspective

Investors must carefully consider various risk factors that could influence the Xe stock price. The following table summarizes these risks, ranking likelihood and potential impact.

| Risk Category | Likelihood | Impact | Mitigation Strategies |

|---|---|---|---|

| Regulatory Delays | Moderate | High | Proactive regulatory engagement; thorough testing and documentation; flexible design |

| Funding Shortfalls | Moderate | High | Diversified funding sources; phased deployment strategy; strategic partnerships |

| Technological Setbacks | Low | Medium | Rigorous R&D robust quality control; expertise-based risk mitigation |

| Public Opposition | Moderate | Medium | Comprehensive public information campaigns; addressing safety concerns transparently |

| Competitive Pressure | High | Medium | Focus on cost leadership; unique value proposition; efficient operations |

Investing in X-Energy: A Calculated Approach

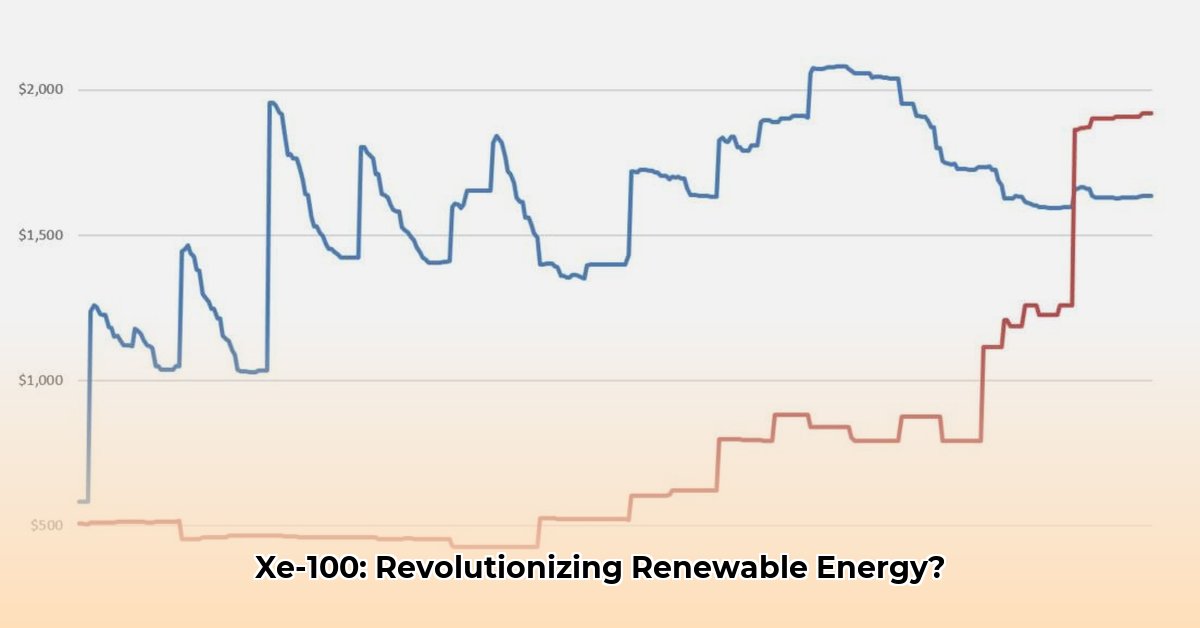

Investing in X-Energy demands a nuanced understanding of both the potential rewards and inherent risks. The Xe-100 showcases promising technological advancements; however, translating this potential into commercial success necessitates navigating significant regulatory, financial, and market-based challenges. The current Xe stock price may not fully reflect the long-term value of the Xe-100 technology. Some analysts suggest the stock is currently undervalued, while others remain more cautious, citing the complexities of entering a competitive market with a novel nuclear technology. The ultimate trajectory of the Xe stock price depends heavily on the company's success in overcoming these challenges.

Three Pivotal Points for Investors:

- The Xe-100's innovative design offers significant safety and efficiency advantages.

- Securing adequate funding and navigating regulatory hurdles are crucial for success.

- Public perception and competition will significantly impact market adoption.

Mitigating Regulatory Risks: A Strategic Framework

Successfully deploying the Xe-100 requires a proactive approach to mitigating regulatory risks. This involves a multi-faceted strategy focused on communication, safety, and public engagement.

Steps to Mitigate Regulatory Risks:

- Proactive Regulatory Engagement: Early and transparent communication with regulatory bodies is crucial to ensure a smoother approval process.

- Robust Testing and Validation: Rigorous testing and third-party verification provide confidence in the reactor's safety and performance.

- Comprehensive Risk Assessment: Identifying and mitigating potential risks proactively helps prevent regulatory delays.

- Public Education and Engagement: Building public trust through transparent communication enhances project acceptance.

- Legal Expertise: Leveraging legal expertise ensures compliance with all applicable regulations.

- Adaptability and Flexibility: Responding effectively to changing regulatory environments is essential for long-term viability.

"The regulatory landscape for nuclear technology is complex, but proactive engagement and a commitment to safety are paramount for success," says Dr. Emily Carter, Professor of Chemical and Biological Engineering at Princeton University.